There has been a big bang moment of newly available data sets, when nearly all information, including financial activities, has moved online. Also, technological advancements now enable machines (i.e., computer code) to copy and, in some cases, replace much of the work previously performed by human analysts.

Technical Skills required for a Data Scientist in the Fintech Industry:

Financial Modelling:- Financial modelling is largely in charge of creating and assessing financial models in order to anticipate market trends. To develop in the fintech business, a data scientist must have a thorough grasp of financial modelling and be able to construct complex models. Finance modelling is a statistical field that focuses on particular skills and methodologies. It is primarily concerned with sophisticated statistical methodologies. The analytical technique is easily applicable to financial models. The data analyst may readily forecast the company’s costs and revenues by using financial modelling. A budget may assist a business in tracking its success and making appropriate modifications as needed. Financial models are used to assess the business and compare it to its competitors in the industry. They may also understand the firm based on input and output and predict expectations.

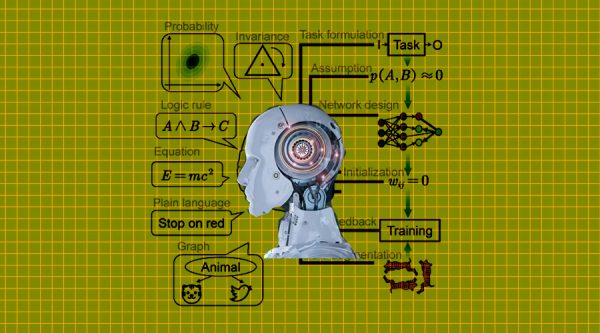

Machine Learning:- To uncover patterns in data sets and make insightful predictions, data scientists need a solid grasp of machine learning techniques. When determining how to proceed in making predictions about the future based on the past, data scientists may readily infer both supervised and unsupervised learning. However, he feels at ease with both accurate and inaccurate statistics because both are important in the preparation of data. Unquestionably, machine learning in FinTech reduces the risk factors for engagement rings and facilitates loan approval. It lowers the risk factor by employing the widely used credit scoring methodology. Using machine learning techniques, the organisation can swiftly build and develop a financial system that can alert you to any potential issues. Furthermore, depending on previously saved historical data, informed decisions could be made.

Data Visualisation:- To help stakeholders understand the newly discovered insights, data scientists use data visualisation. Data representation in the form of graphs and charts, which highlight patterns and trends in data and enable fast comprehension, can be a useful tool for data visualisation. Data classification and new idea generation are made simple with the aid of data visualisation tools. When done correctly, data visualisation lowers noise in the data, presents essential information, and is quite helpful when dealing with large amounts of data to quickly sort it throughout the interpretation process.

Programming:- Python is a popular programming language that focuses on logic and programming, thus data scientists must be fluent in it. It is used to resolve problems that are too big for standard programming languages to handle via both quantitative and non-quantitative methods. One of Python’s key benefit is the availability of modules that quicken data processing and enable precise statistical computing. Python is usually needed for complex computations and compiling historical data and is used professionally in fintech companies. Python is effectively implemented in qualitative financial applications that process and analyse large volumes of data.

How Does Data Science Help Financial Companies?

Analyze survey findings for customer satisfaction– Using big data, assess the level of customer satisfaction based on survey results. For example, it assists financial companies in identifying the rate and causes of client churn and in devising fresh strategies to keep their audience engaged in their services. It has also been used to manage product and feature requests, as well as to analyse customer service patterns.

Analyze client behaviour and create new products- Customer preferences and dislikes change based on the situation. Historical financial big data allows firms to investigate changing consumer behaviour and develop lucrative goods and services that improve banking procedures.

Forecasting future market trends- A FinTech business utilises big data to analyse the evolving financial industry. These organisations can watch purchase behaviour and forecast future trends by having access to historical data. As a consequence, they may utilise this information to make important decisions that improve the client experience.

Credit card Fraud detection- Machine learning algorithms are capable of detecting anomalous credit card transactions and fraud. The first and most significant stage is to collect raw data and then clean it (removing unnecessary characters and making it understandable) to make it more organised and categorized, which is then used to train the model to forecast the probability of fraud.

The stages involved in identifying fraud in credit card transactions are as follows:

● Using methods such as logistic regression, random forests, support vector machines (SVMs), and others to determine if credit card transactions are genuine or fraudulent.

● Credit card profiling can predict if cardholders or fraudsters are using credit cards.

● To detect credit card fraud, outlier detection algorithms are used to distinguish significantly different transactions (or ‘outliers’) from ordinary credit card transactions.

● Machine learning (ML) algorithms outperform traditional fraud detection techniques. They are capable of recognising thousands of patterns in enormous datasets. By evaluating app use, payments, and transaction methods, ML provides insight into how consumers behave.

Predicting who will use international cards in the future months- A machine learning system can forecast which consumers will use overseas cards in the next months based on prior customer data such as travel history and card spending. This data will assist businesses in providing customised offers to clients to enhance revenue.

BFSI technologies have completely changed the landscape of banking payment operations by utilizing data science and AI. Instant payments and paperless transactions with quick transaction updates in safe systems are a must. Today’s banking and finance professionals should develop new data science and AI abilities to compete for the best positions in the industry by mastering these technologies. As a new and rapidly developing business, FinTech absorbs all information and ideas that enhance its products and digital ecosystems. Unlike traditional banks, digital banks’ structure is more adaptable, allowing them to interact with current services and employ cutting-edge data mining techniques.