The Indian startup ecosystem has been flying high over the last couple of years. After raising $42 Bn in 2021, Indian startups cumulatively raised $19 Bn across 900 funding deals in the first half of 2022 despite the funding winter.

The funds raised by Indian startups in H1 CY22 were almost double of the cumulative fund raise of $10 Bn during the same period last year. In fact, it was much more than the cumulative funds raised by Indian startups during the same period in the last eight years.

Besides, the average ticket size also rose 10% year-on-year (YoY) to $22 Mn in H1 2022. The average ticket size stood at $20 Mn and $16 Mn in the corresponding period of 2021 and 2020, respectively.

The rising investment figures and deal counts are suggestive of investors’ growing confidence in Indian startups despite unfavourable market sentiments.

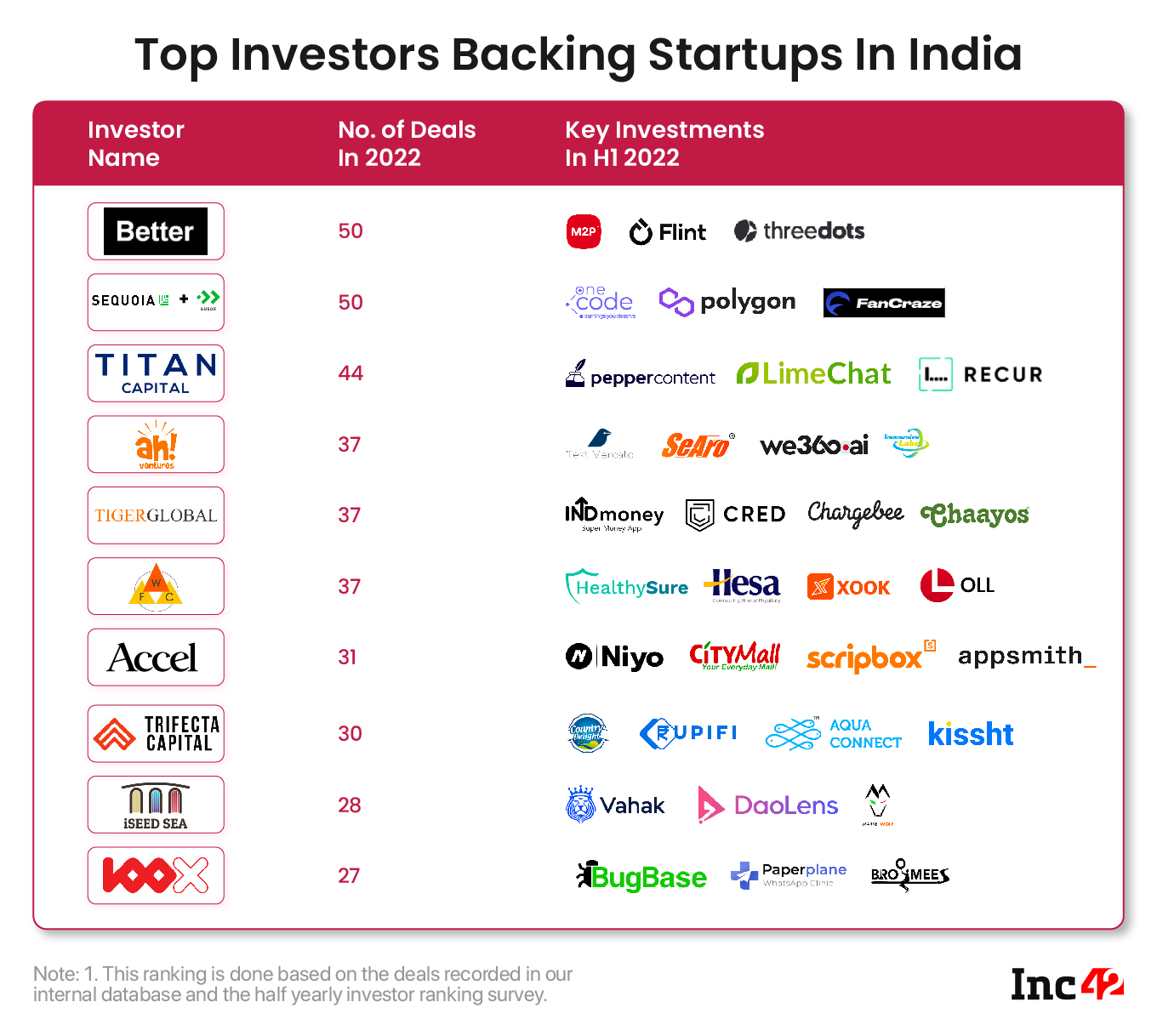

Here’s a list of the top 31 investors (venture capital funds, venture debt funds, angel networks, others) who participated in the funding rounds of Indian startups in the first half of 2022 (January-June 2022):

Note: This ranking is done based on the deals recorded in our internal database and the half-yearly investor ranking survey. If you wish to be included in our survey list, write to us at editor@inc42.com.

Top Investors Backing Indian Startups

Better Capital

Founded in 2018 by Vaibhav Domkundwar, Better Capital is a India-focussed pre-seed venture firm. It has a portfolio of over 150 Indian startups, including slice, Rupeek, Open, Khatabook, Bijak, Airmeet, Teachmint, Kutumb, and Dukaan.

Better Capital has invested in over 175 companies so far that have a cumulative valuation of over $7 Bn, according to its website.

Last year, it launched a sector-agnostic fund of $15.28 Mn that would invest $300K in nearly 40-50 pre-seed and seed-stage startups. Better Capital participated in 50 funding rounds of startups like M2P, Flint and threedots in the first half of 2022.

Sequoia Capital India

Bengaluru-based Sequoia Capital India has backed more than 400 startups in India and Southeast Asian countries. Of these, 13 startups have been listed on the bourses so far.

In 2019, Sequoia India launched an investment program called Surge to support early-stage startups working in India and Southeast Asian (SEA) countries. Recently, Surge announced that it would infuse $3 Mn in Seed and Pre-Series A funding rounds of startups.

Prior to that, Sequoia India and Sequoia Southeast Asia together closed a $2.85 Bn fund. Of this, $2 Bn is committed for early and growth-stage Indian startups, while the remaining $850 Mn would be allocated to startups working in the SEA region.

In the first six months of 2022, Sequoia India, along with Surge, collectively participated in 50 investment deals of startups like OneCode, Polygon and FanCraze.

Titan Capital

Founded in 2019 by Snapdeal founders Kunal Bahl and Rohit Bansal, Titan Capital is an early-stage investment company.

Titan Capital has raised over $10 Bn from more than 100 institutional investors. Its portfolio includes Ola, Razorpay, Ofbusiness, Snapdeal, Mamaearth, and UrbanCompany, among others, according to its website.

Last year, the investment firm participated in 105 funding deals of startups such as Supertails, kindlife.in, and Anar. In 2022, it has invested in funding deals of 44 startups, like Pepper Content, LimeChat and Recur, so far.

Ah! Ventures

Angel investors Harshad Lahoti and Abhijeet Kumar launched the venture capital firm in 2009. The sector-agnostic investment firm backs early-stage startups in India.

Currently, Ah! Ventures has a network of over 2,000 angel investors and 1,000 VCs. It has invested nearly $28.5 Mn in 54 startups so far. Meanwhile, it has also exited 10 startups so far, according to its LinkedIn page.

Recently, ah! Ventures set up an AIF angel fund with a corpus of around $14 Mn. The sector-agnostic fund will invest in early-stage startups that are operating in India as well as international markets.

In the first six months of 2022, the venture capital firm invested in 37 startups like Text Mercato, SeAro, we360.ai and Immersive Labz.

Tiger Global

Founded in 2001, the New York-based venture fund invests in private and public businesses across internet, software, consumer tech and fintech sectors. Its public equity, which was launched in 2001, follows a long-term investment approach, while its private equity business, which was set up in 2003, has infused capital in hundreds of growth-stage and pre-IPO companies in over 30 countries.

Last year, Tiger Global participated in 58 funding deals of startups including Pristyn Care, Apna, and Captain Fresh. In the current year, it has backed 37 startups in aggregate – CRED, Chayoos, Chargebee and INDmoney, among others.

WeFounder Circle

Founded by Neeraj Tyagi, CA Gaurav V Singhvi and Bhawna Bhatnagar, investment platform WeFounder Circle was set up in 2020. Besides making strategic investments in startups, it also makes cross-border investments, offers mentorships and a networking community to startups.

So far, WeFounder Circle has participated in over 100 investment deals and has a network of 3,200 investors, according to its website.

In the first half of 2022, it made investments in 37 funding deals of startups, including HealthySure, Hesa, XooK and OLL, among others.

Accel

Venture capital firm Accel entered India in 2005 and later launched a India-focussed fund called Accel India Venture Capital Fund worth $10 Mn in 2008.

In March, Accel secured $650 Mn for its seventh fund, Accel India VII, for backing early-stage startups in India and Southeast Asia.

At the time of fundraising, Accel said, “We are still at the beginning of this journey and are more enthusiastic than ever to support the entrepreneurs and companies of tomorrow.”

Accel participated in the funding rounds of 31 startups in H1 2022 – Niyo, City Mall, Scripbox, Appsmith, among others.

Trifecta Capital

Founded in 2015, venture debt firm Trifecta Capital invests in startups working in internet, technology and consumer sectors.

In February, Trifecta Capital secured INR 1,500 Cr for its equity fund, The Trifecta Leaders Fund – I, and additionally decided to raise INR 375 Cr as a green shoe option. Prior to this, it announced the first closure of its third venture debt fund, which has a corpus of INR 750 Cr, in November last year.

Last year, it backed 11 Indian startups including Practo, The Good Glamm Group, and ixigo. On the other hand, in 2022, it has participated in funding deals of 30 startups, including Country Delight, Rupifi, Aqua Connect, and Kissht, so far.

iSEED SEA

Founded in 2020 by Utsav Somani, Singapore-based iSeed SEA invests in tech-enabled startups across Southeast Asia and India.

At the time of its launch, Somani stated that iSeed SEA would invest in a minimum of 30 startups in the following two years. He said the fund would invest $150,000 apiece in early-stage tech-enabled startups.

So far in 2022, it has participated in funding deals of 28 startups, such as transport marketplace platform Vahak, B2B startup DaoLens and investment platform MarketWolf.

100X.VC

Industry veteran Sanjay Mehta launched the venture capital fund in 2019. The sector-agnostic venture fund essentially invests in early-stage startups via India SAFE Notes, which is a substitute for convertible notes.

In April, 100X.VC unveiled the name of 10 startups – Zerobalance, BugBase, Emo Energy and Pilk, among others – that would be part of its seventh cohort (Class 07). In the same month, it also set up an INR 125 fund with an aim to invest in 100 early-stage startups in the coming 12 months.

In the first half of 2022, the venture fund backed 27 notable startups, including Paperplane and Bromees.

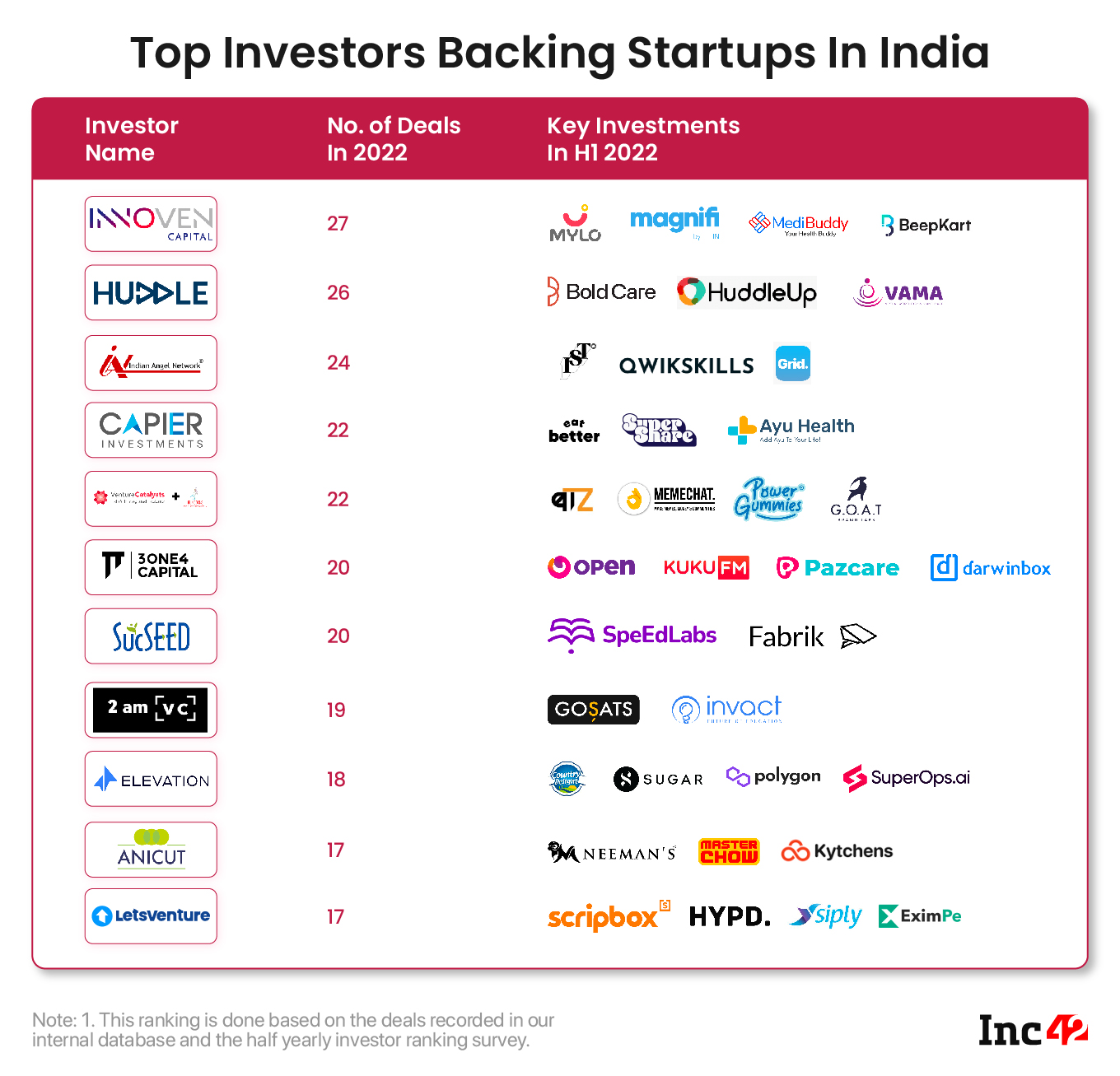

InnoVen Capital

InnoVen Capital, founded in 2008, is a sector-agnostic venture capital firm that backs growth-stage startups across diverse sectors. It was earlier known as SVB India Finance. After its acquisition by Temasek Holdings in 2015, it was rebranded to InnoVen Capital.

In 2021, it invested in 50 Indian startups, including online furniture platform PepperFry, B2B ecommerce platform Udaan, and ecommerce rollup platform Mensa Brands.

In the first half of 2022, it invested in 27 Indian startups. Some of its recent investment bets were in D2C mother and baby brand MYLO, fintech app Magnifi, healthtech startup MediBuddy, and mobility startup BeepKart.

Huddle Accelerator

Launched in 2017 by Ishaan Khosla and Sanil Sachar, Huddle Accelerator invests in early-stage startups working in sectors such as electric vehicles, D2C brands, retail and distribution, gaming and deep-tech.

Huddle writes cheques between $150K and $300K. Its portfolio includes 45 Indian startups – Wellversed, Bold Care, Cell Propulsion, RACEnergy, Celcius, NeuroPixel.ai, Hapramp, F5, The New Shop, among others.

In 2021, Huddle backed 18 homegrown startups like StepSetGo, NeuroPixel, and F5 Refreshment. Meanwhile, in the first half of 2022, it invested in 26 notable startups such as BoldCare, HuddleUp and VAMA.

Indian Angel Network

Founded in 2006, Indian Angel Network (IAN) is an investment platform for angel investors. It primarily invests in early-stage startups that are working in diverse sectors such as agriculture, ecommerce, hospitality, education, financial services, gaming, healthcare and lifestyle.

IAN invests between 400K and 600K in Indian startups. It generally holds a startup for a minimum of three to five years in its portfolio.

In recent years, it invested in drone startup Dhruva Space, gamification platform Unotag and agritech startup Fyllo. On the other hand, it invested in 24 startups, including alcobev startup IST, test-prep platform QWIKSKILLS, and business analytics startup Grid, in 2022 so far.

Capier Investments

Gautham Kalro and Rohit M.A founded Capier Investments in 2015. The early-stage venture fund essentially backs startups in healthtech, insurtech, fintech, agritech, social media, B2B SaaS, and D2C segments.

In 2021, Capier Investments participated in 64 funding deals of startups like Ambee, Cloudnine Hospitals, and Parentlane.

It has backed 22 startups in India, including food brand Eat Better, online app Super Share and healthtech startup Ayu Health, in 2022 so far.

Venture Catalysts

Founded in 2016 by Dr Apporva Ranjan Sharma and Anuj Golecha, Venture Catalysts is a startup incubator that invests between $500K to $1 Mn in startups. In 2019, it launched a $43.41 Mn fund called 9Unicorns to back early-stage startups across diverse sectors.

In the first two years of its inception, Venture Catalysts incubated startups such as Fynd, Beardo, PeeSafe, Innov8, vPhrase, Supr and DSYH, among others. Currently, it has a network of over 3,000 angel investors in three countries – India, Hong Kong and Qatar.

Venture Catalysts and 9Unicorns together invested in 22 funding deals of notable startups, like Baaz Bikes, MemeChat, Power Gummies and G.O.A.T, in the first half.

3one4 Capital

Pranav Pai and Siddharth Pai launched the venture fund 3one4 Capital in 2015. The fund essentially backs early-stage startups in fintech, consumer products, SaaS, digital media, climate tech, and digital health sectors.

3one4 currently manages a corpus of over $310 Mn and has a portfolio of over 50 early-stage startups, including Licious, Darwinbox, Jupiter, Betterplace, Open, Bugworks, Koo, Dozee, and Tracxn, according to its LinkedIn page.

In the first six months of 2022, the Bengaluru-based VC fund invested in 20 homegrown startups, including neobank startup Open, podcast platform Kuku FM, online insurance platform Pazcare and HR software Darwinbox.

SucSEED Indovation

Founded in 2016, SucSEED Indovation was initially started as a Network of Angel and later rebranded to SucSEED Angel Network and ultimately, transitioned into SEBI-registered angel fund SucSEED Indovation Fund. Currently, it has a corpus of INR 100 Cr.

SucSEED primarily invests in Indian startups in sectors such as fintech, edtech, healthtech, enterprise SaaS, regtech and security, and digital economy and emerging technologies. Its portfolio includes 24 startups, including TruScholar, We360.ai, stack and FreeStand.

It has made 20 investments in the startup ecosystem so far in 2022. Some of the notable startups it has invested in are SpeEDLabs and Fabrik.

2am VC

Entrepreneur and investor Bredan Rogers and Hershel Mehta launched the sector-agnostic venture fund in 2020. The VC fund backs early-stage homegrown startups that are led by millennials.

Currently, 2am VC is investing out of its Fund 1, and has so far invested in several startups, including BimaPlan, Intervue.io, BurnCal, Bluelearn and Karbon Card.

In 2021, the venture fund had announced that it would invest $10 Mn in over 50 homegrown startups by the end of the 2022. It has backed 19 startups, including Bitcoin rewarding startup GoSats and education-focussed metaverse platform Invact, during the first half of 2022.

Elevation Capital

Founded in 2002 by Ravi Adusumalli, the Gurugram and Bengaluru-based Elevation Capital essentially backs early and growth-stage startups.

So far, Elevation Capital has infused close to $2 Bn in over 150 startups like FirstCry, Makemytrip, Meesho, NoBroker, Paytm, Swiggy, and Unacademy. Of these, 13 startups have become unicorns.

In April, the venture capital firm set up a $670 Mn Fund VIII that would back early-stage startups in consumer tech, consumer brands, fintech, SaaS and Web3 sectors.

Meanwhile, in the first half of 2022, it invested in over 18 notable startups like dairytech startup Country Delight, D2C brand Sugar, enterprisetech startup SuperOps.ai and blockchain startup Polygon.

Anicut Capital

Anicut Capital, founded in 2016 by Ashvin Chadha and IAS Balamurugan, currently manages an equity-based angel fund, Anicut Opportunities Fund I, and two debt funds – Grand Anicut Fund I and Grand Anicut Fund II.

In June, Anicut Capital marked the first closure of its sector-agnostic Anicut Opportunities Fund I after raising INR 110 Cr. The fund will infuse between $2 Mn and $5 Mn in 10-15 growth-stage Indian startups.

Prior to this, Anicut Capital bagged INR 140 Cr from the Small Industries Development Bank of India (SIDBI) to close its second debt fund, Grand Anicut Fund II.

So far in 2022, the venture capital firm has invested in 17 Indian startups, including footwear brand NEEMAN’S, food company MASTER CHOW, and cloud kitchen startup Kytchens.

LetsVenture

Shanti Mohan and Sanjay Jha set up LetsVenture in 2013. The early-stage syndication platform has a wide network of over 10,000 investors across 60 countries.

LetsVenture’s spokesperson told Inc42 that the investment firm has infused over INR 2,800 Cr in startups across 722+ funding deals till date. It has a portfolio worth over $7.5 Bn and has launched 100 micro VC funds so far.

It is backed by marquee investors like Accel, Chiratae Ventures, Nandan Nilekani, Sharad Sharma, Anupam Mittal, Ratan Tata, Rishad Premji, and Mohandas Pai.

In January, LetsVenture partnered with MeitY Startup Hub to build a conducive startup ecosystem for the country. Besides, it also launched an investment syndicate for its portfolio companies called LV Fuel.

In 2021, it set up a business entity called Trica and also participated in funding rounds of startups like MentorKart, Dukaan and Meddo.

Meanwhile, so far in 2022, it has participated in funding rounds of 17 startups, including Scripbox, HYPD, Siply and EximPe.

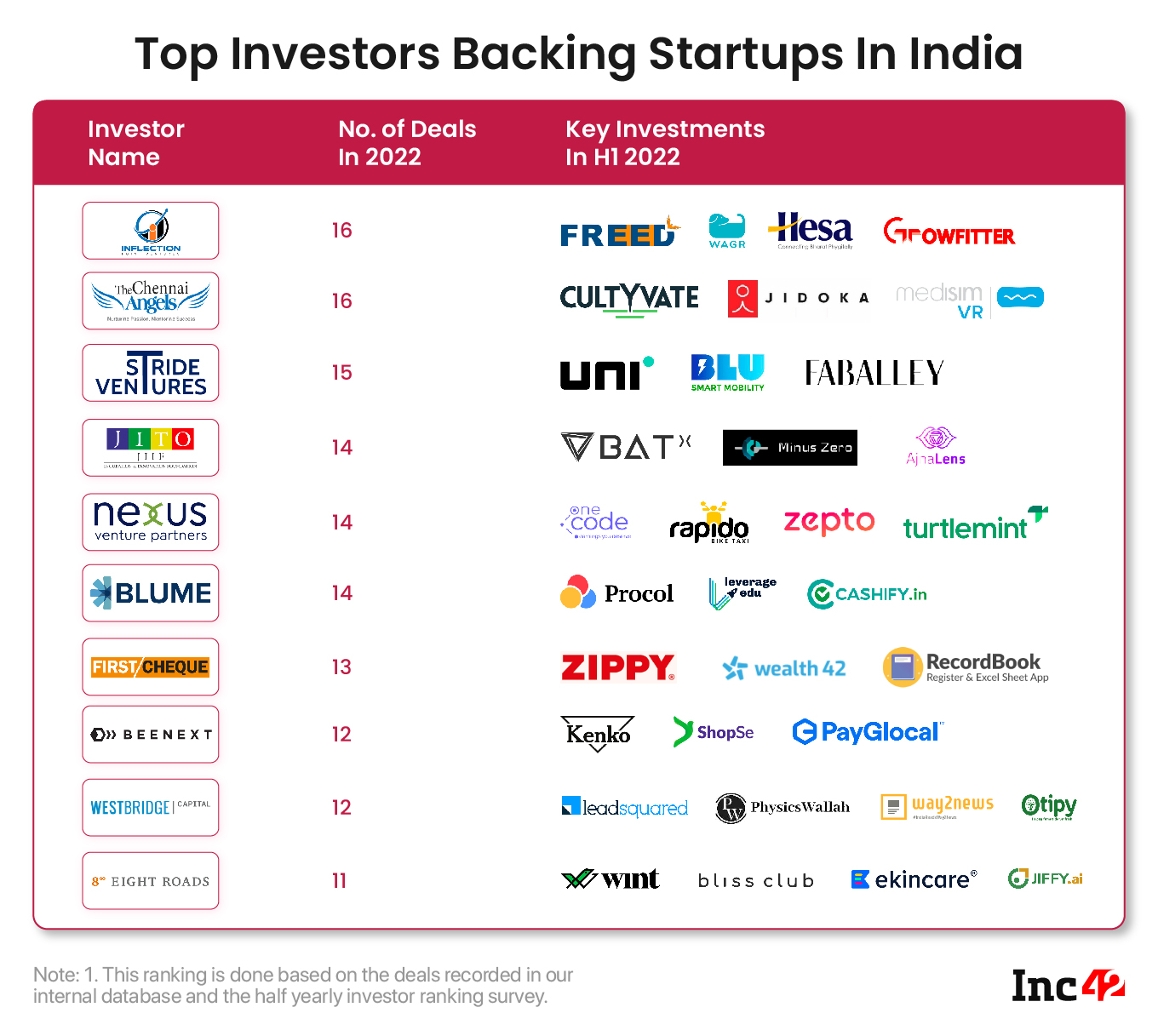

Inflection Point Ventures

Founded in 2018 by Vinay Bansal, Ankur Mittal, Mitesh Shah and Vinod Bansal, Inflection Point Ventures has a network of over 7,000 angel investors.

Inflection invests in early-stage startups that are working across sectors such as healthcare, sports and fitness, retail finance, HR, AI in hiring, education, supply chain and logistics, among others.

In 2021, Inflection participated in 45 funding rounds of startups, including Vested Finance, Stylework, and LoanKuber. Meanwhile, in H1 2022, it participated in funding rounds of 16 notable startups, such as Hesa, FREED, WAGR and GROWFITTER.

The Chennai Angels

Founded in 2007 by Ramaraj R, The Chennai Angels is an angel network that invests in early-stage and growth-stage startups working across sectors such as agritech and sustainability, electric vehicles, deep science and technology, healthtech, fintech and Web 3.0.

So far, The Chennai Angels has invested over INR 150 Cr in aggregate in over 70 startups.

In 2o21, the Chennai-based angel network participated in 20 funding deals of startups such as TrulyMadly, POPxo, Purplle, The Postbox, and Ketto. In 2022, it has invested in 16 startups in total, including CultYvate, JIDOKA, and MediSim VR, so far.

Stride Ventures

Founded in 2019 by Ishpreet Gandhi, Delhi-based Stride Ventures is a sector-agnostic venture debt fund that primarily invests in growth-stage startups.

So far, Stride Ventures has made 62 investment deals across 15 diverse sectors. Its portfolio companies have together raised $4 Bn till now, according to its website.

Last year, it participated in 43 funding deals of Indian startups such as Pocket Aces, TenderCuts, and The Good Glamm Group. In the first six months of 2022, it backed 15 startups, including UNI, BLU, and Faballey.

JITO Angel Network

Mumbai-based JITO Angel Network, founded in 2017, is a subsidiary of Jain International Trade Organisation.

The angel network has backed over 50 startups to date. Last year, it invested in 20 startups, including HomeCapital, Siply, Blusmart, Vidyakul, S3V Vascular Technologies, Galaxy Card, Finance Peer, Taquanal Energy, Epigeneres, and Fello.

In the first six months of 2022, the angel network participated in 14 funding rounds of startups like BatX Energies, Minus Zero and AjnaLens.

Nexus Venture Partners

Founded in 2006, Nexus Venture Partners is an India-US venture fund that invests in early and growth-stage startups working in sectors such as technology, internet, healthcare, consumer, business services, media, fintech, data, software, education, gaming, SaaS, and commerce.

Over the years, Nexus has exited 25 startups, including Zomato, MapMyIndia, Olx, WhiteHat Jr, Unicommerce. In 2021, it invested in funding rounds of notable startups like Quizizz, Postman, and Zepto.

In the first half of 2022, it participated in 14 funding deals of notable startups, including OneCode, Rapido, Zepto and Turtlemint.

Blume Ventures

Karthik Reddy and Sanjay Nath founded Blume Ventures in 2011. The early-stage venture fund helps tech-enabled startups through capital infusion as well as mentorship.

Blume Ventures launched its first fund with a corpus of $20 Mn in 2011, second fund with a corpus of $60 Mn in 2016, third fund with a corpus of $102 Mn in 2020 and fourth fund with a corpus of $200 Mn in 2021, according to its website.

The venture capital firm has also exited various startups such as ZipDial, Taxi For Sure, 1CLICK, Framebench, Runnr, Zenatix, Mettl, ThreadSol and E2E, among others, so far. In the first half of 2022, it infused funds in 14 Indian startups, including Procol, Cashify, and Leverage Edu.

First Cheque

Launched in 2018, First Cheque invests in pre-seed and seed-stage startups working in diverse sectors such as healthcare, real estate, education and financial products etc.

Mumbai-based First Cheque invests between $40K and $100K in early-stage startups in India. In 2021, it backed over 70 startups, including online calendar app Loopin, health insurance startup ClainBuddy and edtech startup Questt.

In the first half of 2022, the venture capital company participated in 13 funding rounds of startups such as online job portal Zippy, fintech app wealth42, and online excel sheet app RecordBook.

BEENEXT

Singapore-based entrepreneur Teruhide Sato launched Bee Next in 2015. The venture capital company invests in South East Asia, India, Japan and the US.

BEENEXT’s portfolio includes Indian startups like digital payments app BharatPe, SaaS startup Blue Sky Analytics, smart parking platform Get My Parking, ecommerce platform Instamojo, device recycle management platform Servify and investment syndicate platform AngelList.

BEENEXT has backed 12 Indian startups, including health insurance app KenKo, BNPL app ShopSe and fintech app PayGlocal, in 2022 so far.

WestBridge Capital

Set up in 2000, WestBridge Capital is an investment firm that primarily focuses on late-stage startups working in India and South Asian countries. It invests between $25 Mn to $200 Mn in Indian startups, and also manages over $5.6 Bn worth of assets.

Last year, it backed 15 Indian startups, including DealShare, Vedantu and Rapido. In 2022, it participated in 12 funding rounds of startups like LeadSquared, PhysicsWallah, Way2News and Otipy, so far.

Eight Roads

Eight Roads, founded in 1969, invests in tech-enabled and healthcare companies. It has a presence in India, China, Europe and Japan.

Eight Roads’ portfolio includes over 300 companies. Of these, over 60 companies have been listed for IPOs to date. Its assets under management (AUM) stand at $11 Bn, according to its Linkedin page.

Last year, the venture capital company invested in over 35 startups, including fintech startup Uni, edtech startup Quizizz and pharmacy marketplace PharmEasy. Meanwhile, it participated in 11 funding rounds of startups such as fintech startup Wint, women’s D2C clothing brand Bliss Club, healthtech startup ekincare, and enterprisetech startup Jiffy.ai, in the first six months of 2022.

Source: inc42.com