India’s BEV sales remains low compared to other key markets, with around 5,357 sold in 2020, or less than 0.5 per cent of cars sold.

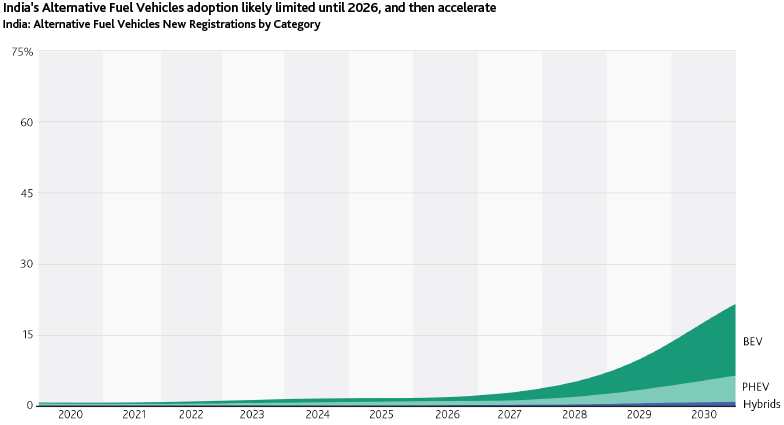

Sales of Alternative Fuel Vehicles (AFVs) accounted for less than 1 per cent of total vehicle sales in India in 2020 and their adoption is likely to remain limited till 2026 before it starts accelerating, according to Moody’s Investors Service.

AFVs are vehicles with propulsion systems other than strictly gasoline-based powertrains, such as Battery Electric Vehicles (BEVs), Plug-In Hybrids (PHEV) and All Other Hybrids.

“We estimate new vehicle registrations of AFVs in India will grow to 3-5 per cent by 2025 — with most of the growth from BEVs — then climbing at a faster pace toward the government’s target of 30 per cent of BEVs by 2030,” the firm said in a report on AFV adoption globally.

It added that tighter emission regulations and purchase incentives will provide the BEV segment a much needed fillip, though availability and sufficiency of batteries could limit overall AFV sales to closer to 20 per cent in 2030.

“India’s BEV sales remains low compared to other key markets, with around 5,357 sold in 2020, or less than 0.5 per cent of cars sold. Including PHEVs, we estimate India’s AFV sales to be less than 1 per cent of the 2020 total,” the report said.

In 2020, most BEVs sold were Sport Utility Vehicles and Tata Motors’ share in the segment stood at close to 70 per cent.

The report said that globally the pace of investment in AFVs, especially BEVs, is accelerating with stricter emission regulations and more consumer adoption. Among the AFVs, demand for BEVs will grow fastest, but automakers are spending heavily on plug-in hybrids (PHEVs) too.

AFVs share of global vehicle registrations will accelerate to approach 40 per cent by the end of the decade and regions that would exceed the global average for new registrations are Europe (over 70 per cent), and Japan and Korea (over 60 per cent), according to Moody’s.

Automakers will face roadblocks in achieving profitability in the BEV segment including high battery costs; reaching sufficient demand to produce BEVs at scale; and the complexity of effectively integrating a broad range of mobility services with BEV products.

Source-energy.economictimes.indiatimes.com