India has a serious problem with online fraud, which includes identity theft, phishing scams, and phony e-commerce websites. India has seen an increase in cybercrime, with over 5,000 cases of online identity theft reported there in 2022. The number of phishing attempts has also increased; in 2020, 83% of IT teams in Indian organizations reported an increase in phishing emails directed at their staff members. In addition, 38% of customers report having received a fake item from an online retailer in the last 12 months.

A research claims that a large number of fraudulent transactions happen between 10 PM and 4 AM, mostly targeting credit card holders who are over 60 years old. India accounted for 77.4% of all cybercrimes reported between January 2020 and June 2023. In one Indian city, the number of cybercrime cases increased from 2,888 in 2020 to nearly 6,000 in 2023.

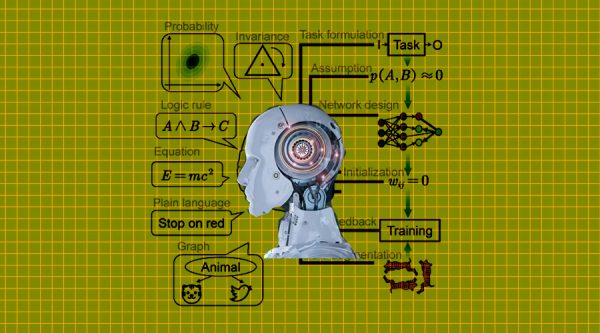

Machine learning plays a crucial role in preventing fraud by helping organizations identify and stop suspicious activity instantly. Conventional approaches to preventing fraud frequently fall short of the ever-evolving strategies used by con artists. Large volumes of data may be swiftly analyzed by machine learning algorithms, which aids in the identification of trends and abnormalities by organizations that might point to questionable behavior. These algorithms continuously improve their capacity to identify suspicious activity by learning from previous fraud cases. Organizations may prevent fraud and successfully preserve their assets by incorporating machine learning into their tactics.

The capacity of machine learning to identify questionable activity early on is a major benefit in the fight against fraud. Machine learning algorithms detect suspicious transactions in real-time, allowing organizations to take immediate action and avoid financial losses. They do this by analyzing past data and seeing patterns of questionable behavior.

Machine learning and graph databases have shown to be effective tools for detecting fraud. Graph databases are valuable for many applications, including fraud detection, since they capture and analyze network interactions at fast speeds. They can find patterns and connections in large amounts of data, which lowers the complexity and makes it easier for detection algorithms to find instances of fraud in a network.

In summary, in order to effectively combat the evolving techniques of scammers, organizations need to change their fraud protection strategies accordingly. Graph databases and machine learning are strong tools in this continuous war. These technologies are more accurate than humans at detecting suspicious activity because of their quick analysis of many data points. It is similar to having an all-night, nonstop squad of superhuman fraud investigators. Scammers create new deception techniques just as quickly as organizations identify and stop suspicious activity.