NFT trading, which makes it possible to buy, sell, and exchange distinctive digital assets on blockchain networks, has grown to be a significant component of the digital economy. In contrast to fungible and interchangeable cryptocurrencies such as Bitcoin or Ethereum, NFTs are non-transferable and signify ownership or verification of the legitimacy of certain digital content, which can include anything from virtual real estate and collectibles to music and art.

NFT trading starts with the production of digital assets by developers, artists, or other producers who tokenize their creations by minting NFTs on blockchain networks like Ethereum. After that, these NFTs are put up for sale on specific websites or online markets, where potential customers may find them and buy them with cryptocurrency, usually Ether (ETH).

The capacity of NFT trading to offer unchangeable proof of provenance and ownership thanks to blockchain technology is one of its primary characteristics. The blockchain records a unique identification for every NFT, guaranteeing its scarcity, legitimacy, and ownership background. The core features of NFTs’ value proposition are their traceability and transparency, which give collectors and purchasers trust in the digital assets they purchase.

As a result of its increasing popularity, NFT trading has drawn interest from investors, collectors, celebrities, and artists looking for novel approaches to monetize digital material and interact with consumers. The digital goods market has experienced notable expansion in recent years, as evidenced by high-profile sales of digital artworks, music CDs, virtual real estate, and other unique inventions that command millions of dollars.

NFT trading is not without its difficulties and detractors, though, since there are worries about market speculation, copyright violations, and the environmental effects of blockchain networks’ high energy consumption. Furthermore, uncertainties regarding the NFT market’s viability and long-term worth persist, forcing platforms, participants, and regulators to manage new risks and overcome regulatory ambiguities.

NFT trading, in spite of these difficulties, signifies a paradigm shift in the purchasing, selling, and valuation of digital assets, opening up new avenues for purchasers to acquire rare and distinctive digital collectibles and for creators to monetize their creations. Stakeholders in the NFT market must work together and be creative as it develops further to guarantee its long-term sustainability in the digital era and its responsible expansion.

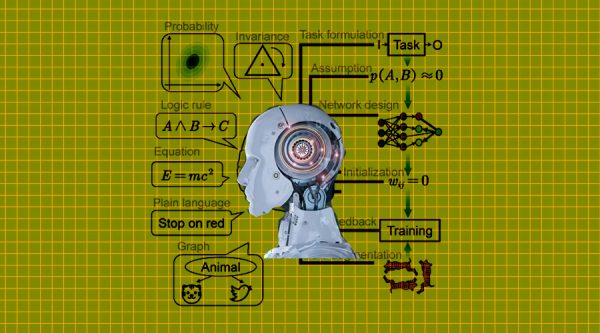

Machine learning

Within the field of artificial intelligence (AI), machine learning is the branch that focuses on creating statistical models and algorithms that let computers learn from data and make judgments or predictions without having to be explicitly programmed to do so. To enable computers to generalize and make predictions or decisions in novel situations, machine learning aims to teach them patterns and relationships from data.

Large datasets are used to train machine learning algorithms, which then examine and spot patterns, trends, and correlations. Different sorts of tasks and data require different types of machine learning methodologies, such as reinforcement learning, unsupervised learning, semi-supervised learning, and supervised learning.

Algorithms are trained on labeled datasets in supervised learning, where each data point is connected to a target output or label. Through the reduction of the error between expected and actual values, the algorithm gains the ability to translate input features to the proper output.

On the other hand, unsupervised learning entails training algorithms on unlabeled datasets with the intention of finding hidden structures or patterns in the data. Common tasks in unsupervised learning are dimensionality reduction and clustering.

In order to increase model performance, semi-supervised learning leverages a small amount of labeled data in addition to a larger amount of unlabeled data, combining elements of both supervised and unsupervised learning.

With feedback in the form of rewards or penalties, algorithms are trained to interact with their surroundings and discover the best decision-making techniques via trial and error in reinforcement learning.

Applications for machine learning can be found in many different fields, such as natural language processing, recommendation engines, predictive analytics, autonomous cars, and picture and audio recognition. In both corporate and research environments, machine learning is becoming more and more crucial for extracting insights and making data-driven decisions as data volume and complexity increase.

NFT Trading with Machine Learning

With NFT (Non-Fungible Token) trading, machine learning is being used more and more to assess market patterns, forecast asset values, and enhance trading tactics. Machine learning algorithms can be used in the context of NFT trading to find trends and forecast the future behavior of digital assets by utilizing market sentiment research, transaction history, and other pertinent factors.

Price prediction models are one way that machine learning is used in NFT trading. To predict the potential value of NFTs, these algorithms examine variables such historical sales data, asset characteristics, creator reputation, and market demand. Machine learning algorithms can detect patterns and trends that could affect future asset valuations by training on past price movements and pertinent attributes. This allows traders to make better informed decisions about purchasing, disposing of, or holding NFTs.

Sentiment analysis of the market is another area where machine learning has potential applications. Through the examination of news articles, social media conversations, and other information sources, machine learning algorithms are able to determine the general sentiment of individual NFT projects or the market as a whole. Important insights into investor sentiment, prospective market movements, and new possibilities and threats can be gained from this sentiment study.

Moreover, automated trading bots or algorithms that carry out trades in accordance with preset standards or plans can be created using machine learning techniques. These algorithms are able to assess data in real-time, execute trades at the best times to maximize profits or reduce risks, and continuously monitor market circumstances.

All things considered, machine learning has a lot of promise to improve NFT trading by giving traders insightful information, predictive analytics, and automated trading tools. Machine learning algorithms are anticipated to become more crucial in assisting traders in navigating the intricacies of this new asset class as the NFT market develops and expands.

Machine learning’s significance for NFT trading

Price Prediction: To help traders make well-informed investment decisions, machine learning algorithms can examine past sales data, asset characteristics, market trends, and other variables to forecast the future value of NFTs.

Market Sentiment Analysis: Through the examination of news articles, social media posts, and other information sources, machine learning is able to determine the general mood of the market or the sentiment of investors about individual NFT projects. This allows for the prediction of future market movements.

Risk management: By examining variables like volatility, liquidity, and correlation with other assets, machine learning algorithms can evaluate the risk involved with NFT investments, assisting traders in more skillfully controlling their exposure to risk.

Automated Trading: Traders can take advantage of market opportunities and maximize their trading performance by using machine learning algorithms to create automated trading bots or algorithms that execute transactions based on predetermined criteria or strategies.

Portfolio Optimization: By finding assets with high potential returns and low correlation, diversifying risk, and maximizing overall portfolio performance, machine learning algorithms can help traders optimize their NFT portfolios.

Fraud Detection: In order to shield traders against con artists and market manipulation, machine learning algorithms are able to identify fraudulent actions including wash trading, pump and dump schemes, and phony NFT listings.

Market analysis: Large volumes of NFT market data can be analyzed by machine learning algorithms, which can then find patterns, trends, and correlations that human traders would miss and use to inform their decisions.

Price arbitrage: By identifying chances for arbitrage across various NFT marketplaces or assets, machine learning algorithms can help traders profit from price differences.

Dynamic Pricing: To maximize profits for NFT sellers, machine learning algorithms have the ability to dynamically modify pricing methods in response to changes in the market, shifts in demand, and competition activity.

Market Making: By offering liquidity and enabling trades in NFT marketplaces, machine learning algorithms can function as market makers, supporting price stability and enhancing market effectiveness.